Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Friday, June 25, 2010

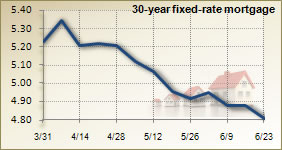

I had heard from several of my clients this week that interest rates were VERY low --- but I didn't know they were the lowest EVER! Current rates are the lowest on record, according to BankRate.com and others.

I had heard from several of my clients this week that interest rates were VERY low --- but I didn't know they were the lowest EVER! Current rates are the lowest on record, according to BankRate.com and others. Of note, I two of my clients locked in this week at 4.375% and 4.5% --- wow!

How do these incredibly low interest rates affect you?

- If you have an interest rate above 5.5%, it might be worthwhile considering a refinance.

- If you are buying anytime in the next six months, now may be a considerably more favorable time to buy rather than later.

Put another way --- if you were buying a new townhome this week, could it be helpful to have an extra $1,600 in your pocket? Or an extra $2,700 in your pocket? Buying now, with low rates, can save you that much (annually) as compared to your costs if rates start to increase.