Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Wednesday, May 5, 2010

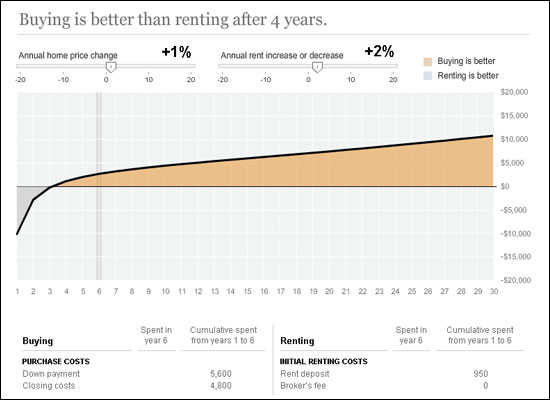

Lots of people who are renting have thought about buying . . . and lots of people who are thinking of buying wonder whether they should keep renting. Here's a highly interactive calculator to help you compare your options, thanks to the New York Times.

Using this online calculator, you can enter in all sorts of variables including all of your up front and ongoing costs for buying as well as renting. The resulting graph shows you how long it would take for it to have been worthwhile to have bought instead of renting.

The illustration above is with a $160,000 townhome purchase, compared to renting the same townhome for $950 per month. With a 5% interest rate on a 97.5% mortgage, it would take four years to be worthwhile to buy --- if home values were increasing at 1% per year. In the first three years, your annual costs would be higher for having bought. Starting in the fourth year, your annual costs would be LOWER for having bought.

Longer term normalized price increases per year range from 3% to 4%. With 3% per year increases in home values, you start having annual savings each year after only two years.

If you are wondering whether you should rent or buy a home, feel free to use this handy calculator, or schedule a time to meet with me and I can help you explore the pros and cons of each option.

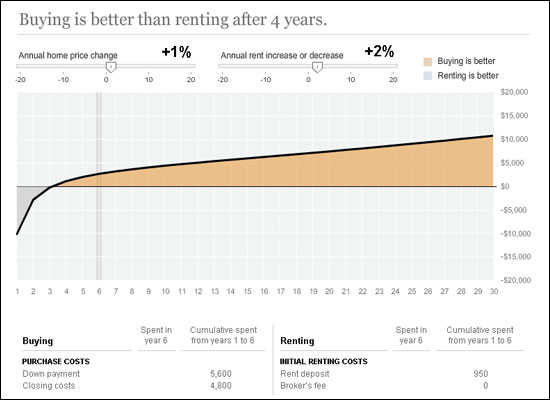

Using this online calculator, you can enter in all sorts of variables including all of your up front and ongoing costs for buying as well as renting. The resulting graph shows you how long it would take for it to have been worthwhile to have bought instead of renting.

The illustration above is with a $160,000 townhome purchase, compared to renting the same townhome for $950 per month. With a 5% interest rate on a 97.5% mortgage, it would take four years to be worthwhile to buy --- if home values were increasing at 1% per year. In the first three years, your annual costs would be higher for having bought. Starting in the fourth year, your annual costs would be LOWER for having bought.

Longer term normalized price increases per year range from 3% to 4%. With 3% per year increases in home values, you start having annual savings each year after only two years.

If you are wondering whether you should rent or buy a home, feel free to use this handy calculator, or schedule a time to meet with me and I can help you explore the pros and cons of each option.