Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Tuesday, March 3, 2009

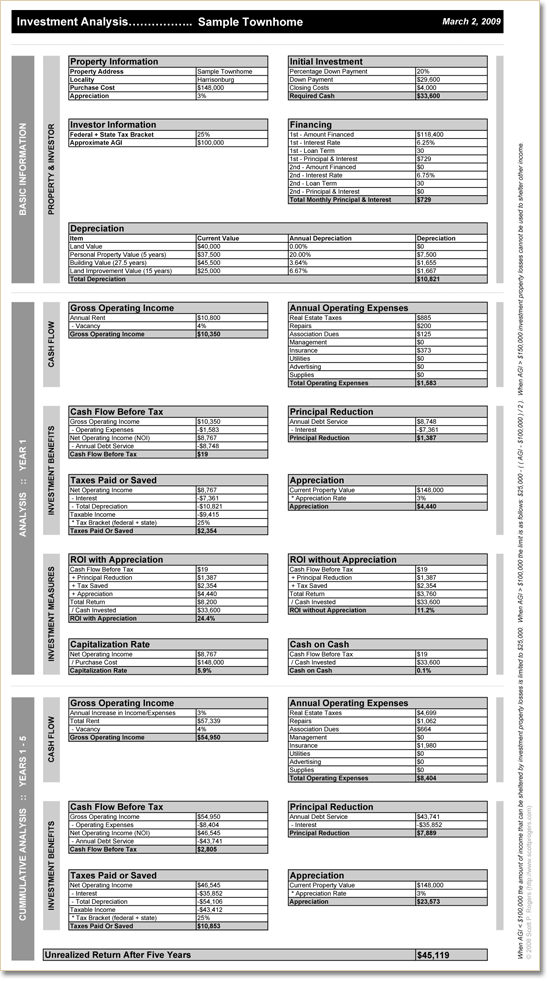

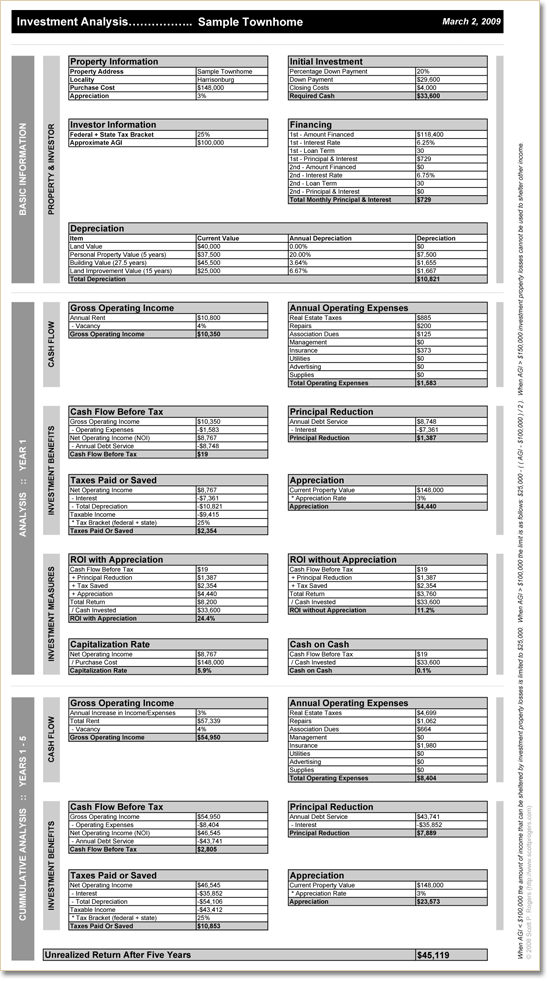

When considering the purchase of an investment property, you ought to account for the following investment benefits:

Click on the image for more detail.

- Cash Flow Before Taxes - if your rental income is $900 per month, and your expenses (mortgage, etc) are $800, you have positive cash flow.

- Principal Reduction - unless you have an interest-only loan, each monthly rent payment helps to reduce the principal balance of your mortgage.

- Tax Savings - this can vary significantly depending on your individual financial situation, but the "loss" (including depreciation) on your investment property can be used to reduce your tax liability.

- Appreciation - though our current appreciation rate is somewhere between -1% and 2%, this is (in a longer timeframe0 an important investment benefit.

Click on the image for more detail.