Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Monday, January 12, 2009

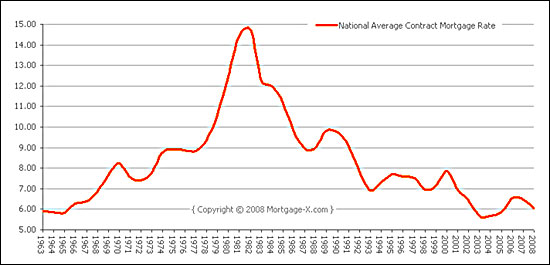

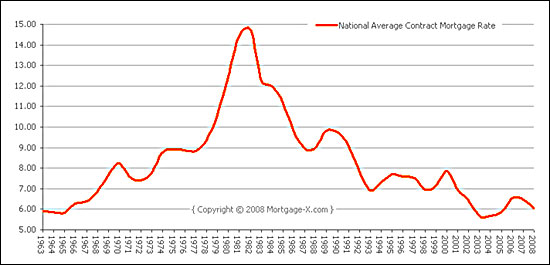

Some of the agents in my office remember when interest rates were as high as 15% for a 30 year fixed rate mortgage. Wow! Who could afford to buy at those rates!?

Today's rates, roughly 4.75% on a 30 year fixed rate mortgage, provide for great opportunities for those considering a home purchase. Here are a few examples of how this rate would affect a monthly payment, as compared to an interest rate of 6.5%, which we saw not too long ago!

First time buyer of a city townhome at $155,900 (100% financing):

Principal & Interest at 6.5% = $985 / month

Principal & Interest at 4.75% = $813 / month

Savings = $172 / month = $2,064 / year!

Upper-end Barrington Home at $459,000 (80% financing):

Principal & Interest at 6.5% = $2,261 / month

Principal & Interest at 4.75% = $1,915 / month

Savings = $346 / month = $4,152 / year!

As you can see, these low interest rates can make a significant difference in a buyer's monthly budget!

Today's rates, roughly 4.75% on a 30 year fixed rate mortgage, provide for great opportunities for those considering a home purchase. Here are a few examples of how this rate would affect a monthly payment, as compared to an interest rate of 6.5%, which we saw not too long ago!

First time buyer of a city townhome at $155,900 (100% financing):

Principal & Interest at 6.5% = $985 / month

Principal & Interest at 4.75% = $813 / month

Savings = $172 / month = $2,064 / year!

Upper-end Barrington Home at $459,000 (80% financing):

Principal & Interest at 6.5% = $2,261 / month

Principal & Interest at 4.75% = $1,915 / month

Savings = $346 / month = $4,152 / year!

As you can see, these low interest rates can make a significant difference in a buyer's monthly budget!