Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Thursday, November 6, 2008

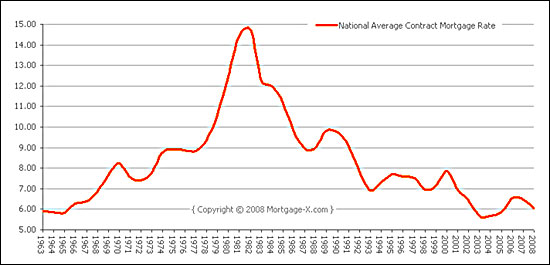

Reproduced with the permission of Mortgage-X.com

It's anyone's guess what interest rates might do in the next 3, 6 or 12 months, but rates continue to be historically low. Given these low rates, you may be considering whether it would be worthwhile to refinance.

Here's a sample analysis of whether "Bob" should refinance, that might be helpful as you analyze your own scenario. Here's what you need to know about Bob....

- Home Value = $275,000

- Original Mortgage = $212,500 @ 7% for 30 years

- Current Balance = $200,000 (after five years, thus 25 years remaining)

- Current Payment = $1,414/month (principal & interest)

- Refinance Opportunity = 6.25% with a fee of $2,500

One important note --- Bob lowered his payment by $167/month by refinancing not only because he lowered his rate, but also because he extended his remaining loan term from 25 years back up to 30 years.

So, bottom line...

- Can refinancing your mortgage lower your monthly payment? Absolutely!

- Can you recoup the cost of the refinancing process? Absolutely!

- Should everyone refinance if the current rates are lower, or if it would lower their monthly payments? Not necessarily!