Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Thursday, January 8, 2026

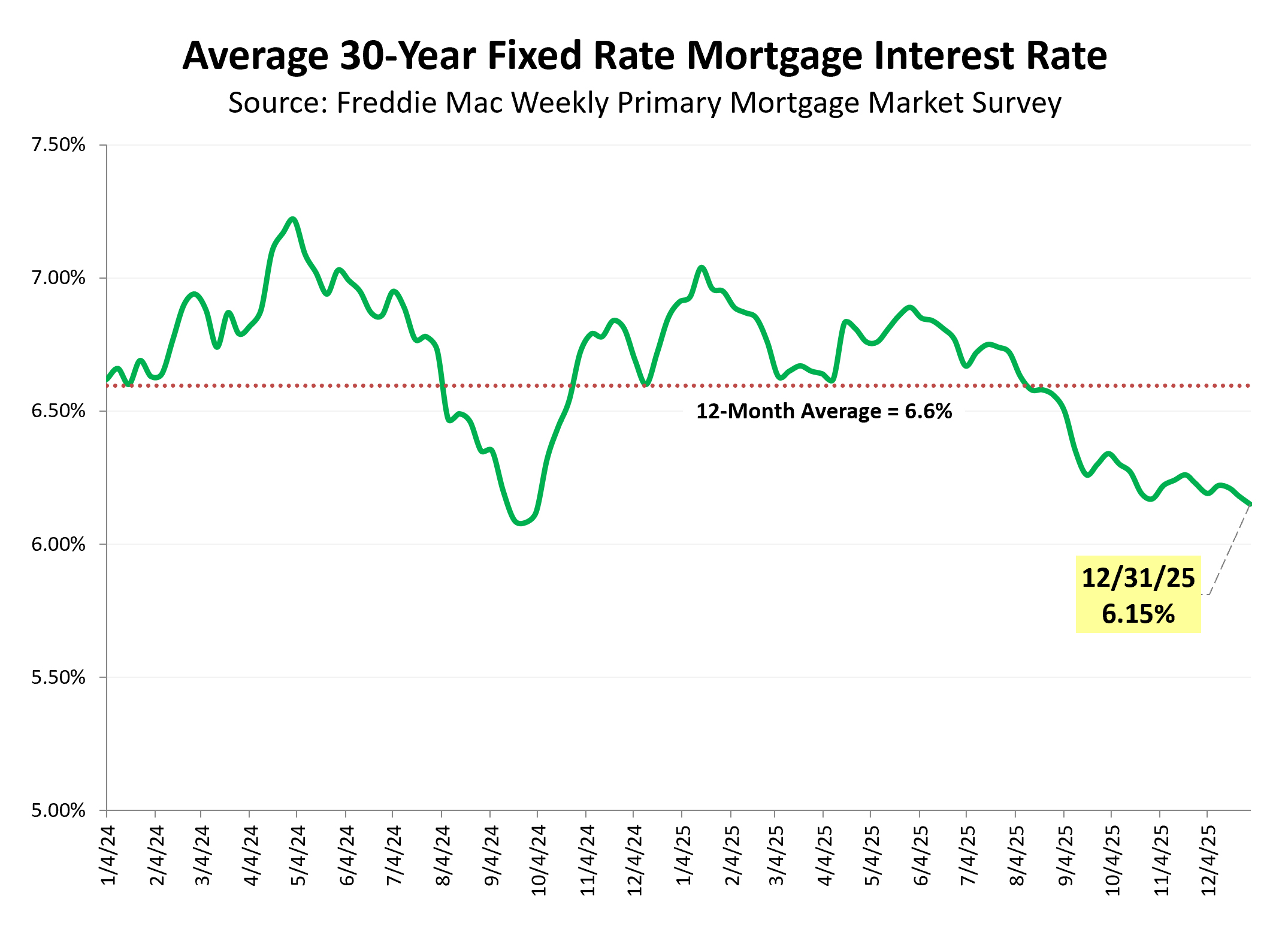

Over the past six months, mortgage interest rates have been steadily trending downward. After rising above 7% earlier in 2025, the average 30-year fixed mortgage rate ended the year at 6.15%... well below the 12 month average of 6.6%.

So, what might this mean for buyers and sellers as we head into 2026?

Buyers...

Lower mortgage rates can potentially translate into more affordable monthly payments. If you were priced out of the market over the past few years in part due to high interest rates, declining rates may make it more feasible for you to purchase a home in 2026.

Sellers...

On the selling side, declining rates may mean (slightly) more buyers can consider your home. In much of 2025, sellers were selling in a market where buyers were very cautious due to higher borrowing costs. If interest rates continue to ease, we may see more buyers ready to make a get into the market -- particularly if they've been waiting on the sidelines for lower rates.

What's next for 2026?

If rates remain in the low 6% range -- or dip further -- buyers may have more confidence and purchasing power, and sellers could benefit from increased activity.

So, what might this mean for buyers and sellers as we head into 2026?

Buyers...

Lower mortgage rates can potentially translate into more affordable monthly payments. If you were priced out of the market over the past few years in part due to high interest rates, declining rates may make it more feasible for you to purchase a home in 2026.

Sellers...

On the selling side, declining rates may mean (slightly) more buyers can consider your home. In much of 2025, sellers were selling in a market where buyers were very cautious due to higher borrowing costs. If interest rates continue to ease, we may see more buyers ready to make a get into the market -- particularly if they've been waiting on the sidelines for lower rates.

What's next for 2026?

If rates remain in the low 6% range -- or dip further -- buyers may have more confidence and purchasing power, and sellers could benefit from increased activity.