Brought to you by , Funkhouser Real Estate Group, , scott@HarrisonburgHousingToday.com

Thursday, November 6, 2025

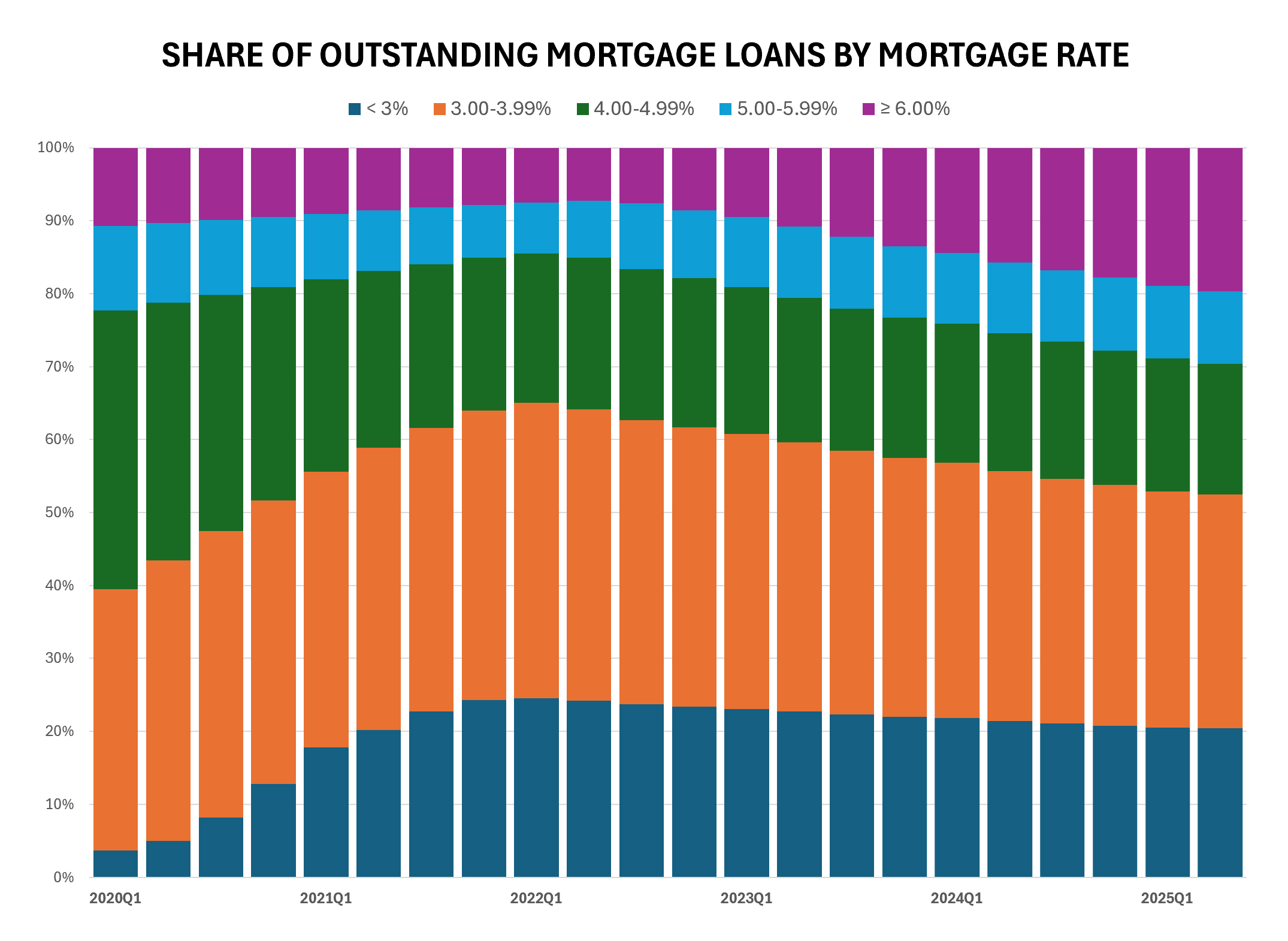

Lots of people bought a home or refinanced their mortgage when mortgage interest rates were quite low!

Three years ago (in mid 2022) over 60% of mortgage holders had mortgage interest rates below 4%... and only 7% had a rate above 6%!

As mortgage interest rates for new purchases rose to 6% and then almost to 7%... all those mortgage holders (60%) of them with rates at or below 4% had very (very!) little interest in selling their homes to buy a new home. After all, who would want to trade a rate below 4% to a new rate above 6%?

But... after a few years now, we're starting to see a shift.

Let's look at the lowest and highest portion of rates at two points in time...

Mid-Year 2022:

Three years ago (in mid 2022) over 60% of mortgage holders had mortgage interest rates below 4%... and only 7% had a rate above 6%!

As mortgage interest rates for new purchases rose to 6% and then almost to 7%... all those mortgage holders (60%) of them with rates at or below 4% had very (very!) little interest in selling their homes to buy a new home. After all, who would want to trade a rate below 4% to a new rate above 6%?

But... after a few years now, we're starting to see a shift.

Let's look at the lowest and highest portion of rates at two points in time...

Mid-Year 2022:

- 24% of mortgages had a rate below 3%

- 7% of mortgages had a rate above 6%

- 20% of mortgages had a rate below 3%

- 20% of mortgages had a rate above 6%