Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Friday, October 24, 2025

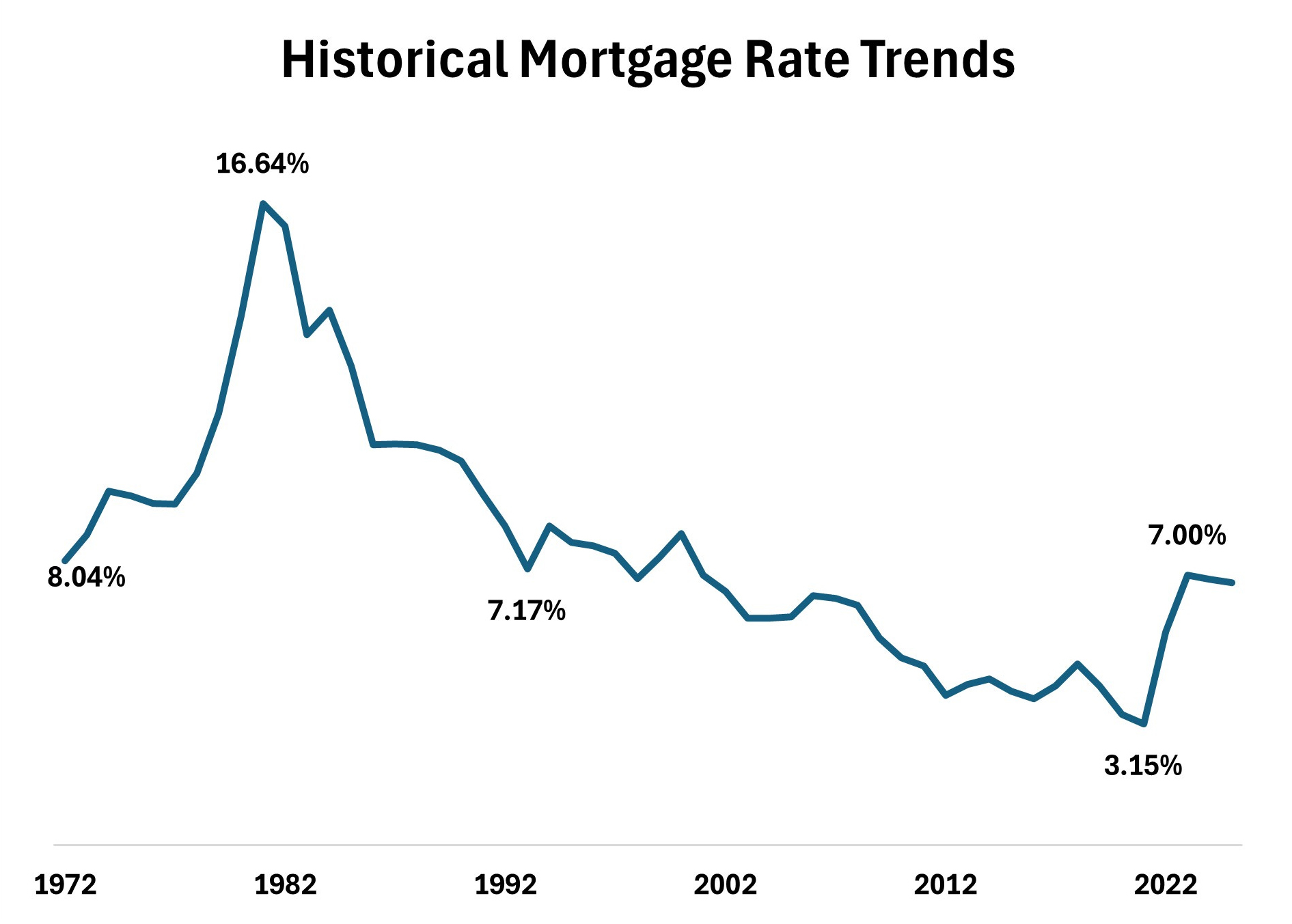

Mortgage rates have been a frequent topic of conversation lately. The average 30-year fixed rate is now in the low 6% range, currently about 6.27%.

Still, after a few years of incredibly low 2 - 4% rates during COVID, today’s rates can feel painfully high. It may help to look at the bigger picture.

So what have mortgage rates looked like over time?

Quick History Lesson

Before the Federal Housing Administration (FHA) was created in 1934, only 1 in 10 Americans owned a home.

That changed when the 30-year fixed mortgage was introduced, making home-ownership possible for many more people.

What the Numbers Tell Us

Looking back over the past 50 years:

So, while today’s rates may feel high compared to recent years, they are actually in line with historical averages.

The Big Picture

Very low rates tend to get a lot of attention, but they are not typical. The sub-3% mortgages from 2020 and 2021 were unusual. Historically, rates in the mid-6% range are much more common.

It’s understandable to hope for lower payments, but it’s helpful to focus on your long-term plans:

Still, after a few years of incredibly low 2 - 4% rates during COVID, today’s rates can feel painfully high. It may help to look at the bigger picture.

So what have mortgage rates looked like over time?

Quick History Lesson

Before the Federal Housing Administration (FHA) was created in 1934, only 1 in 10 Americans owned a home.

That changed when the 30-year fixed mortgage was introduced, making home-ownership possible for many more people.

What the Numbers Tell Us

Looking back over the past 50 years:

- In 1981, mortgage rates peaked above 16%.

- In 2021, rates dropped to just under 3%, influenced by the pandemic and Federal Reserve policy.

- In 2025, rates have ranged from about 6.3% to 7.2%, with an average near 6.8% in September.

So, while today’s rates may feel high compared to recent years, they are actually in line with historical averages.

The Big Picture

Very low rates tend to get a lot of attention, but they are not typical. The sub-3% mortgages from 2020 and 2021 were unusual. Historically, rates in the mid-6% range are much more common.

It’s understandable to hope for lower payments, but it’s helpful to focus on your long-term plans:

- Buy when you find the right home for your life and budget.

- Refinance if (and when) rates drop.

- Short-term changes in rates are normal, but they shouldn’t keep you from moving forward if the timing is right for you.