Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Wednesday, November 30, 2011

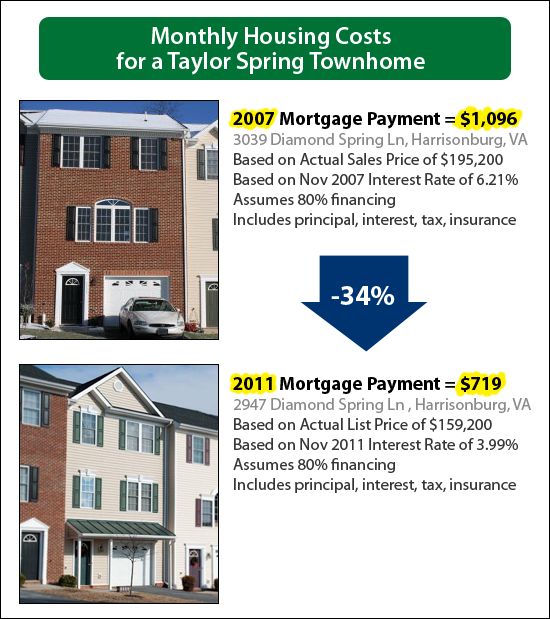

Yesterday I pointed out that monthly housing costs have declined 28% since 2007 because of modest declines in median sales prices and significant declines in average mortgage interest rates. But let's make it a bit more specific....

The first townhouse pictured above was sold in 2007 for just $100 more than the median sales price at the time, and your monthly housing cost would have been $1,096 if you financed 80% of the purchase price at the average interest rate of 6.21%.

The second townhouse pictured above is for sale now for only $159,200, and would require a monthly housing cost of only $719 -- again, assuming you financed 80% of the purchase price at today's average interest rate of 3.99%.

This is quite a dramatic difference (-34%) in housings costs, and hopefully helps to illustrate the wonderful opportunities for buyers in today's market!