Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Monday, July 26, 2010

Investing in real estate isn't for everyone --- and it isn't without its risks. But if you have some money to put into an investment as a down payment, and if you have financial reserves with which to cover maintenance costs and months without rental income, you might be interested in learning more.

The easiest case study of real estate investing in Harrisonburg is to consider the purchase of a two-story townhome built in the last ten years. There are quite a few neighborhoods where these townhomes can be purchased, somewhere between $130k and $160k:

These two-story townhouses in these neighborhoods will likely rent for between $850 to $950 depending on the age and condition. View them on a map here.

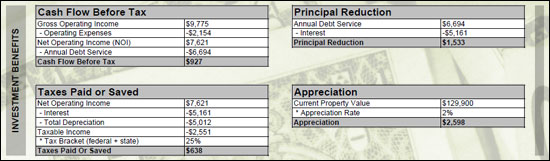

Next, let's assume a great deal on the purchase (we'll shop until we find that deal) with a purchase price of $129,900. However, we'll make lots of conservative assumptions as we continue. For the time being, assume:

- $850 / month rental income

- Half a month's rent lost each year between tenants

- 20% down payment, the balance financed at 5%

This might not seem like much, but when combined with a few other investment benefits, it starts to add up, even in the first year.

Year 1 Investment Benefits

- $926 positive cash flow

- $1,533 principal reduction via rental income

- $638 tax benefit for loss based on depreciation

- Total "Gain" = $3,097

- $6,990 positive cash flow

- $8,492 principal reduction via rental income

- $2,394 tax benefit for loss based on depreciation

- Total "Gain" = $17,876

- $6,990 positive cash flow

- $8,492 principal reduction via rental income

- $2,394 tax benefit for loss based on depreciation

- $13,520 appreciation

- Total "Gain" = $31,396

There are plenty of variables to consider when buying an investment property, but the basics of the cash flow are the first to thoroughly understand. For a head start on everything else you need to learn, review this detailed investment analysis.