Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Brought to you by Scott P. Rogers, Funkhouser Real Estate Group, 540-578-0102, scott@HarrisonburgHousingToday.com

Thursday, November 5, 2009

Earlier this week I attended an educational session put on by the Virginia Association of Realtors in regards to Short Sales which was very informative! I am currently representing a buyer who has a contract on a house that will be a short sale, and I am currently representing a seller whose listing will likely result in a short sale. Thus, in addition to being quite interesting, the top down overview prepared me to better represent my clients.

First, my simplified definition of a short sale is any home sale where the proceeds will not provide the sellers with enough money to pay off the mortgage(s) in full, and where the sellers can't come up with the rest of the money themselves, and where the bank agrees to release the lien against the house anyhow, even though they aren't being paid in full.

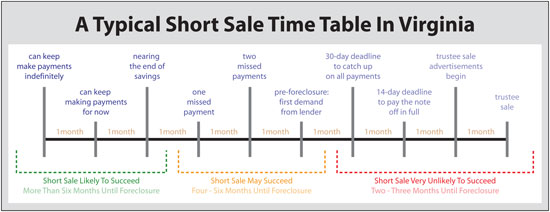

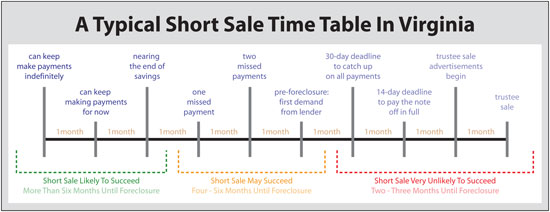

One very helpful part of our training session was an explanation of the typical foreclosure timeline (shown below) and how and when a short sale can fit in to prevent the foreclosure.

Click on the image above for a larger JPG version of the timeline, or click here for a PDF version.

As you can see, above, when a homeowner knows they are headed towards foreclosure there is often still plenty of time to attempt to arrange a short sale rather than to simply wait for the foreclosure to transpire. Yet at the same time, as the foreclosure (trustee sale) looms nearer and nearer, the possibilitiy for a short sale diminishes.

What else do you need to know about short sales and foreclosures? A LOT!

First, my simplified definition of a short sale is any home sale where the proceeds will not provide the sellers with enough money to pay off the mortgage(s) in full, and where the sellers can't come up with the rest of the money themselves, and where the bank agrees to release the lien against the house anyhow, even though they aren't being paid in full.

One very helpful part of our training session was an explanation of the typical foreclosure timeline (shown below) and how and when a short sale can fit in to prevent the foreclosure.

Click on the image above for a larger JPG version of the timeline, or click here for a PDF version.

As you can see, above, when a homeowner knows they are headed towards foreclosure there is often still plenty of time to attempt to arrange a short sale rather than to simply wait for the foreclosure to transpire. Yet at the same time, as the foreclosure (trustee sale) looms nearer and nearer, the possibilitiy for a short sale diminishes.

What else do you need to know about short sales and foreclosures? A LOT!

- If you're selling at a loss, but have the money to pay off the balance of the loan yourself, the bank won't permit a short sale.

- If you defrauded the bank when you applied for and received the mortgage (overstating income, etc) you likely won't be approved for a short sale.

- Lenders usually takes 30-90 days (or more) to provide a conclusive answer on whether they will approve a short sale.

- Lenders won't give you a concrete answer up front as to whether they will approve a short sale --- once you have a contract in hand, they will examine the proposed deal and decide whether to approve it.

- To be approved for a short sale by your lender you (among other things) must prove financial hardship and show that the proposed deal is generating the best possible sale price.

- Short sales can provide for great opportunities for buyers, but you must be willing to be patient and work through convoluted and tedious processes.